Deep learning based sentiment analysis and offensive language identification on multilingual code-mixed data Scientific Reports

6 agosto, 2024It set out $fifteen,100000 and you may obtained a 30-12 months recourse home loan regarding lender A

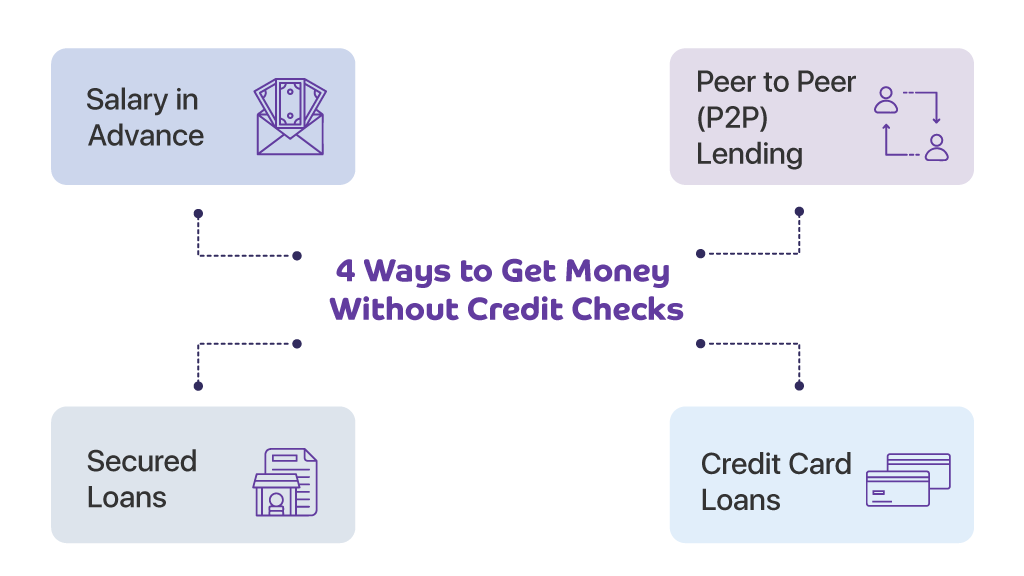

12 agosto, 2024They are supported by collateral, causing quicker chance towards the lender, however, a whole lot more chance for you because the borrower. Any time you continuously neglect to build costs, you could clean out your home or automobile. The good thing about secured personal loans is that the Apr may be lower.

Using up a predetermined-rates unsecured loan means that the newest cost and you may rate of interest you sign up with, doesn’t transform to the life of the mortgage. This is exactly an excellent choice for enough time-title costs as you due to the fact debtor won’t have so you’re able to love your speed fluctuating from year to year, and that sooner saves you cash.

In contrast, variable-rate personal loans will be the opposite. Because they are tied to financial standards, variable-rate financing can be go up otherwise slip. not, the non-public mortgage is less likely to increase this new faster brand new lifetime of the borrowed funds was, making it a less expensive selection for short-term costs.

Debt consolidation money are of these which have multiple sources of loans. Reaching out to a company that provides these loan are generally best for assess your financial situation and get your bills all the towards the you to definitely put. The majority of people choose that it consumer loan since loan providers generally render good all the way down rate of interest as compared to a fantastic expenses shared, so they really save money.

In place of providing a lump sum of money, you need to use which loan into the an as needed foundation and you may is only going to shell out interest about what you borrow

Co-finalized otherwise joint financing are a great selection for those who are unable to qualify for a standard unsecured loan. If the debtor features bad credit, little to no earnings, if any credit history, co-signers act as an insurance coverage on the debtor. Should the debtor are not able to shell out what they are obligated to pay, brand new co-signer generally intends to buy her or him.

Not all the loan providers succeed co-signers, nevertheless the of those no credit check loans in Miami FL who do could offer you a lower life expectancy notice rates, while increasing your odds of taking approved.

A personal line of credit serves just as a typical credit card manage. This type is far more cure into the individuals with ongoing expenditures or getting problems only.

You have seen such financing if you’re shopping on the web. Pick today, or pay five payments out of x matter a month. Ring a bell? Pick today spend afterwards (BNPL) loans will let you pay a tiny section to have an item, followed by other total cost towards a good bi-each week otherwise monthly foundation.

All things considered, BNPL money are best for required, one-time commands which you already don’t have the upfront bucks having. Finally, make use of which have alerting and you will obligations once the certain BNPL programs charge appeal.

The good thing is you won’t need to prequalify for these variety of funds, meaning you could make use of this loan method of irrespective of your own borrowing or financial status

Not all version of loans certainly are the easiest otherwise best option. But not, dependent on your situation, the borrowed funds models listed below can become expected. Make sure to very carefully do your homework and you can evaluate debt situation before you take out any form from financial obligation. In the course of time, this type of financing items is going to be found in a crisis, last resort problem.

Payday loan software had been popping up recently giving an assistance that allows their customers to find a fraction of its salary early. Users often have up to $200 worth of borrowing from the bank power, and this refers to determined by the latest app looking at your financial records.

These services include a registration commission in place of desire, and the application takes back extent you borrowed towards pay-day.

Either from the bank or your neighborhood Atm, you can purchase brief-term charge card enhances placed into your bank account. These enhances do not come without heavier costs, and will getting to 5% for the complete loan amount.