Key Findings About Online Dating Within The U S

26 septiembre, 2024Chatiw Critiques

30 septiembre, 2024Traditional mortgages can make it difficult to pick a house you to definitely that really needs renovation. Choosing a great 203k loan bypasses the individuals activities helping customers allow it to be.

Homebuyers have it difficult in today’s real estate market. With quite a few globe source getting in touch with they «the best seller’s markets ever», searching for a property that fits all of the client’s needs and desires was more complicated than before. Regardless if consumers are lucky enough to get a property it love, they are certainly not capable of getting its pick render acknowledged due to tough competition off their people who will be prepared to spend a made otherwise waive crucial contingencies to obtain their get even offers recognized, and additionally they may not be approved to possess a traditional mortgage to purchase the ideal house. not, customers that are concerned with selecting a home within price assortment and having the bring accepted may have a secret gun from the the discretion: The fresh 203k FHA financial.

Understanding the FHA 203k Mortgage

The brand new FHA 203k mortgage allows homebuyers to find residential property you to definitely come in sub-standard position. As most home loan choices need land to fulfill review and appraisal conditions you to consider her or him safe and able having occupancy, many residential property with a beneficial potential are neglected while they need repairs otherwise renovations.

In an effective firming seller’s industry, consumers that will find the way to buy one of those homes ount of money on the get. Utilising the 203k financing choice, the customer is able to financing the cost of both pick plus the price of renovations in a single simpler mortgage.

Customers Provides Two Choices for 203k Money

203k finance come in each other sleek and you may an entire option, towards the significant difference as being the kind of and you will level of solutions which is often financed. Regarding smooth 203k mortgage, a max fix quantity of $thirty five,one hundred thousand are going to be financed without architectural solutions are permitted. These loan solution positives people who’re to get an effective domestic you to definitely merely need beauty products reaged or outdated floor, painting, fixtures, and you will lights.

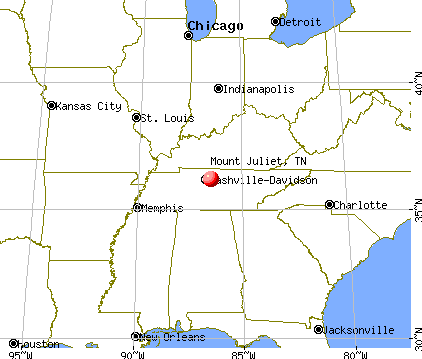

The full 203k mortgage option has no cap into the count regarding fixes it will shelter, for as long as all round loan amount remains contained in this FHA’s deductible financing number toward area where in fact the house is found. Because there is no cover to the number of fixes, buyers may use so it mortgage option to build structural changes otherwise even use the house as a result of their foundation and you can rebuild, whether or not the home into the Franklin or perhaps. (Homes dissolved with regards to rebuilding around a beneficial 203k financing have to, not, keep part of the present foundation in order to be considered.) People who’re looking purchasing a distressed house with significant updates factors will find this as best for the condition.

Evaluating this new Streamlined 203k Loan and also the Basic 203k Loan

How do home buyers who happen to be searching for securing good 203k financing choose between a smooth mortgage and a basic mortgage? These types of concerns assist influence the best choice to make.

- How much cash would you like to possess repairs and relined 203k financing provides all in all, $35000 available for the repairs. There’s absolutely no restrict getting shelling out for repairs toward practical 203k mortgage.

- Will the house or property end up being inhabitable on the renovation? If for example the repairs towards the family prevent you from staying in it anytime throughout the processes, you ought to favor a simple 203k loan.

- Does the home you need architectural repairs? Therefore, you really need to squeeze into the standard 203k, since the sleek 203k loan is just having non-structural repairs.

- How poorly is it possible you hate records? Brand new streamlined 203k has smaller records versus basic 203k. Which is cuts down on the trouble out-of securing a mortgage.

203k Fund Fool around with Fundamental FHA Mortgage Qualifications

Being qualified to have a good 203k mortgage spends an identical guidance useful for traditional FHA financing, offering the add up to feel mortgaged is within the same assortment since the number of the brand new client’s FHA loan limitation having good move-in-able home. You will find, not, some more fees inside it whenever choosing a good 203k mortgage, including:

- Two FHA inspections at $150/for every in order that all the works performed match FHA standards

- Good 203k name inform payment out-of $150 to guard FHA’s status because first lien proprietor regarding the enjoy one to people specialist involved in the home improvements documents a declare disputing commission because of their works

- An effective 203k supplemental origination fee of 1.5% of your price of the new home improvements, or $350, any kind of is actually higher, to handle the increased will set you back of your escrow membership essential for that it loan sorts of

- Good 203k backup set-aside, which is 10-20% of one’s fix quote matter, becoming kept on escrow membership to pay for one cost overruns your panels get incur

Customers that happen to be searching for having fun with a good 203k loan buying and redesign a house is always to plan to talk to an FHA lender as quickly as possible. Because these particular fund have more files and should be tested on the latest Government Property Government (FHA), acceptance and control minutes will likely be lengthy.

Prospective buyers who possess a lot more questions regarding using an FHA 203k financing inside their area is always to discuss the count through its consumer’s broker before loans Canton Valley starting their home research. This will help to provide them with way more insight into the real housing market within their urban area that assist her or him go after whether or not to go after thinking about homes that fit the brand new smooth otherwise full 203k financing assistance.